PTA moderates but spread with paraxylene widens

PTA or purified terephthalic acid, the key raw material to produce polyester – saw prices rise in early May in Asia on incessant buying, coupled with overall slow offtake at the ports. However, since operating rates in polyester industry were to ease, PTA players adopted a cautious stance. During the holiday shortened second week and futures market closed in China, the market saw thin transaction while buyout bids rolled over with limited offers seen. Mid-May saw PTA futures declined 4.4% in China amid a bearish sentiment following the escalation of the US-China trade war.

Spot prices also declined as feedstock paraxylene prices plunged while sales-to-output ratio in downstream polyester industry fell to 60%, curbing demand for PTA. Prices kept declining on slower demand from polyester industry as some factories were on maintenance works and operating rates gradually fell. The average operating rate of plants in China were stable at 86%.

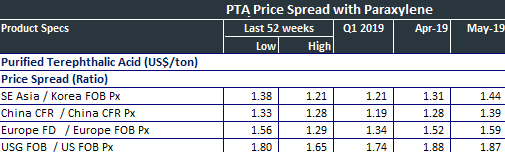

With slower fall in PTA in comparison to paraxylene (raw material for PTA), the price spread between the two widened, in favour of PTA. During May, the premium of PTA spot over paraxylene spot rose to 144% in South Korea from 131% in April. Similarly, in China it rose from 128% to 139%.

In Europe, the spot PTA market saw limited activity because of heavily contracted environment. May contract declined alongside fall in paraxylene contract price.

In US, April prices declined on lower paraxylene cost prices while demand also moderate. May contract prices were lowered by May end on softer paraxylene contract and an unusually weak demand during this time of the year. PTA prices fell 4-5% during the month as against the 12-13% plunge in paraxylene cost.

MEG or mono ethylene glycol, a co-raw material for polyester – saw markets fluctuated in weakness and spot offers inched up slightly in early May as markets saw thin transaction amid a public holiday. Later, they were under the influence of the trade tension between China and US. Mid-May saw MEG prices plunged to a three-year low amid ample supply while demand from polyester weakened as the US-China trade war escalated. By month-end, MEG market activity tapered off, as requirements were mostly covered while expectations of reduced supply in H2 June kept offers firmer.

In Europe, MGE spot prices were pressured down by ample supply, despite ethylene oxide turnarounds scheduled in May while April contract was confirmed. May contract agreement emerged but between one buyer and seller. Meantime, the contract and spot prices gap was notable and buyer preferred spot buying.

In US, MEG supply and demand was more balanced due to increased production in May. May contracts rolled overs as supply and demand were mostly balanced, but downward pressure may continue.

June may see a slightly different trend as the US-China trade dispute take path.