Polyester prices continue to gallop on cost support in lull season

In the week ending 17 August, polyester prices marched rapidly on cost support rather than market fundamentals. The sector remains in a lull season period. Its connection with crude oil was rather feeble this week, but not completely disconnected.

Crude prices declined on worries that oversupply may weigh on the US market and trade dispute and slowing global economy dampen demand. US crude declined for the seventh consecutive week, while European Brent was down for the third week. However, price fall was limited by US sanctions on Iran, which target the financial sector from August and include petroleum exports from November.

Polyester feedstock

Asian ethylene markets remained on a bullish note, but prices did not move much. Participants were focused on steam cracker and downstream plant operations with supply increasing. In Europe, discount for spot over contract narrowed, providing a small boost to spot ethylene prices. Meanwhile, August contract rolled over signaling flatness to downstream users. US spot ethylene prices rose amid higher ethane cost and an upset at CP Chemical’s cracker due to a compressor issue .

Paraylene spot prices in Asia continue to hit their highest points in more than three years, driven by strong downstream markets. This is despite softer energy and naphtha prices. European spot prices were sitting on a four-year high, driven by high Asian values and tight regional supply. August contract price was also agreed at an increase from July. In US, paraxylene export price continued to rise, tracking Asian gains that has opened the US-Asia arbitrage window.

Polyester intermediates

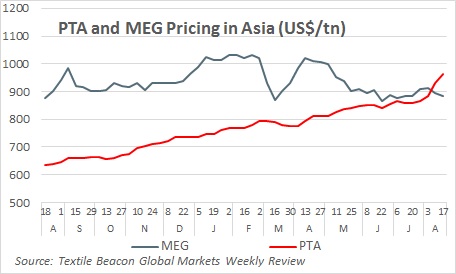

Purified terephthalic acid prices in Asia were on a four year high this week. They will fluctuate at high level in September and October on healthy demand, tight supply and firm paraxylene prices. In China, PTA import prices hit 3-year high narrowing the gap between import and domestic goods. In Europe, PTA August contract increased, moving alongside paraxylene reference contract. However, downstream demand was weak as the peak season for PET was over.

Mono ethylene glycol markets in Asia were under pressure from weakness in Yuan and softer crude oil prices. Trading was thinner as buying appetite tapered off amid sharp depreciation of Yuan against the US$. In Europe, July and August contracts for MEG were not yet to be agreed. Meanwhile in US, players were contemplating long-term impact of China’s 25% tariff imposition on MEG, especially when fresh capacities are slated to come online in 2019. However, China sources just 2% of its total MEG requirement from US.

Polyester fibre chip prices surged in Asia as costs continued to soar amid demand-supply imbalances. Semi dull chip prices were pushed further by strong PTA amid moderate trading. Suppliers were unwilling to sell at low levels. Logistics were adversely impacted by seasonal typhoon, leading to further supply tightness. In Europe, rising production costs for PET was narrowing the gap between spot and feedstock related contract prices.

Polyester fibre and filament

Polyester filament yarn prices continued to climb on strong PTA in China. Nevertheless, trading atmosphere moderated seeing producers with low inventory restraining offtake volumes. In Pakistan, selling indications for locally produced and imported DTYs rolled over but sales cooled down due to unfavorable feedstock.

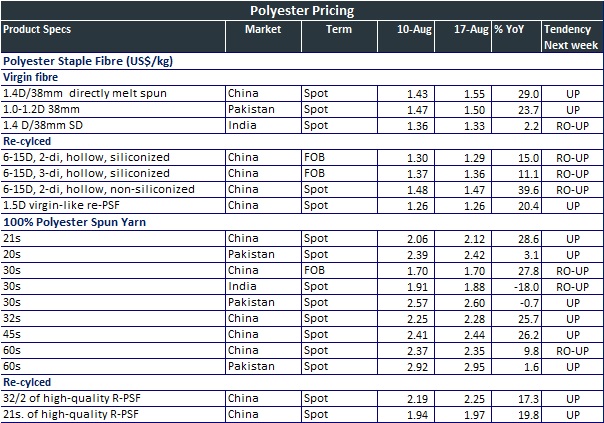

Polyester staple fibre makers faced strong cost pressures from surging PTA cost due to its tight supply. This led to increase in selling indications as makers looked to maintain their operating margins. In China, demand was healthy, with plants running at relatively high run rates and prices rose. In Pakistan, producers raised their offers to reflect rising cost pressure while they remained unchanged in India implying weak demand and slower export orders.

Polyester yarn

Spun yarn of polyester prices moved up in China and Pakistan amid rising cost of PSF. However, the rise in yarn prices were not in proportion with the increment in cost. This implies that spinners are unable to pass on the entire cost but taking hit on their margins due to dull season period.

1 comment on “Polyester prices continue to gallop on cost support in lull season”

I am impressed with this website , really I am a big fan .