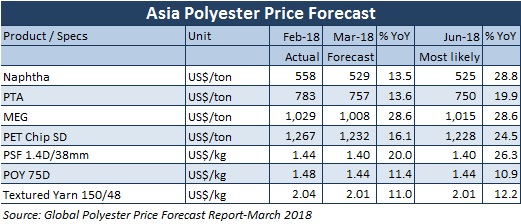

Polyester prices in Asia likely to moderate in March on weak upstream

Polyester prices in Asia are likely to moderate in March 2018, says the Global Polyester Price Forecast report of Textile Beacon. The forecast assumes crude oil prices to move back to US$58 a barrel during the month. IT has already receded to less than US$61 as of yesterday and will remain range-bound and volatile in next few weeks due to production pressures. The US$ will also pressure prices down as it gains among basket of currencies.

This will influence the polyester raw material markets in Asia. PTA and MEG are the two main inputs for manufacture of PET chips and polyester fibre.

The Intermediates

MEG market sentiment in Asia will remain diverged on the outlook in March with several players concerned over the open arbitrage window for cargoes arriving from US to China. This could potentially create a supply glut pushing spot prices to decline in March. PTA prices are likely to remain under pressure as inventory in China has piled after a number of downstream users were shut during the long Lunar New Year holiday in mid-February. During that off period most PTA plants were running at a high run rate of 80%, while about 18% of 50 million ton a year polyester capacity is expected to be taken off line in Q1. The shutdowns are estimated to shave off demand for PTA during the period. In China, around 98% of PTA goes into polyester production.

Polyester chip prices were marching higher in February mainly on cost support rather than market fundamentals. Offers were hiked but were limited by heavy wait-and-see stance of downstream converters. As feedstock will remain range-bound to moderate, PET chip markets are likely to fall or roll over in a soft note in March.

Polyester prices (virgin PSF) firmed up in Asia across China, India and Pakistan in February on cost support. In China, PSF markets were covered by wait-and-see sentiment in early March, indicating softness going ahead. In India, PSF offers were hiked with effect from 1 March on rising cost and modest demand in domestic market. But demand diminished a bit as buyers were conscious of buying at higher price.

Meanwhile recycled PSF markets will remain stable‐to‐firm with offers for hollow R‐PSF were already hiked followed by suppliers and traders in February. Thus, R-PSF prices are unlikely to move down in March and may remained supported by virgin PSF and firm cotton markets.