Polyester price spreads expand across the chain as crude picks up

Polyester price spread has seen major expansion in both downstream segments in Asian markets in May compared to their levels a year ago. However, changes in the upstream – feedstock, were negative despite the gallop in crude oil markets. The international benchmark, US WTI and European Brent gained more than 45% or US$25 a barrel in May this year, and its effect were seen percolating in along the derivatives.

[Polyester price spread is the difference between the price of a raw material and the price of finished product created from that commodity. E.g. Polyester price minus PTA+MEG]

Polyester feedstock ethylene and paraxylene are derivatives of crude oil via naphtha and their prices move along with the energy complex and ethane gas. Also market fundamentals are at play when demand surged with new petrochemical complex begins operation of existing units undergo maintenance turnaround or are shut due to technical issues. Generally large crackers are operated stably for a long period and turnarounds are scheduled in advance.

Ethylene price spread with naphtha in Asia hovered above US$600 a ton in May, down from the previous month, and also from previous year as ethylene spot prices retreated by more than US$100 a ton during the month. Inflow of cargoes from Europe and abysmal price levels in US, dented spot numbers in Asia during May.

Paraxylene, a refinery product, saw its spread with naphtha narrow down this May as spot prices moved slower thatn the energy complex. The spread averaged US$340 a ton for the month, down US$25 compared to same month of 2017.

Polyester intermediates – PTA and MEG spot markets were sluggish during the month but gained strength off late. MEG markets were more volatile in May and spot fell below US$1,000 a ton mark. However, with ethylene spot on the decline, MEG spread expanded dramatically during May. High inventories along east China ports held back the markets to some extend.

PTA spot averaged US$820 a ton and its spread with paraxylene increased to US$145 a ton up US$67 from May last year. PTA spot was supported by production issues in Asian market during May, but were seen resolved as the month came to a close.

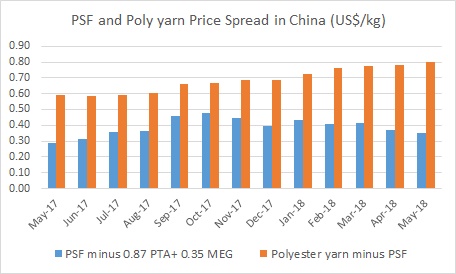

Price spread of polyester POY with PTA and MEG expanded significantly in May this year as spot prices moved up sharply than its raw material. Similar, the spread of PSF with PTA/MEG also improved significantly this May.

Polyester yarn prices moved up sharply in May as demand picked up across the region and PSF prices surged. In China, 32s polyester yarn prices averaged US$2.20 a kg, up from US$1.90 a kg in May 2017. The rise in yarn prices was faster than fibre prices which placed the market in a comfortable margin zone. Prices were also seen recovering from the decline posted in May 2017.

Thus, with positive spread across the polyester chain, any increase in feedstock cost going ahead will provide support to the downstream segment. Or if not, there is enough room for cost absorption, particularly in the yarn market.