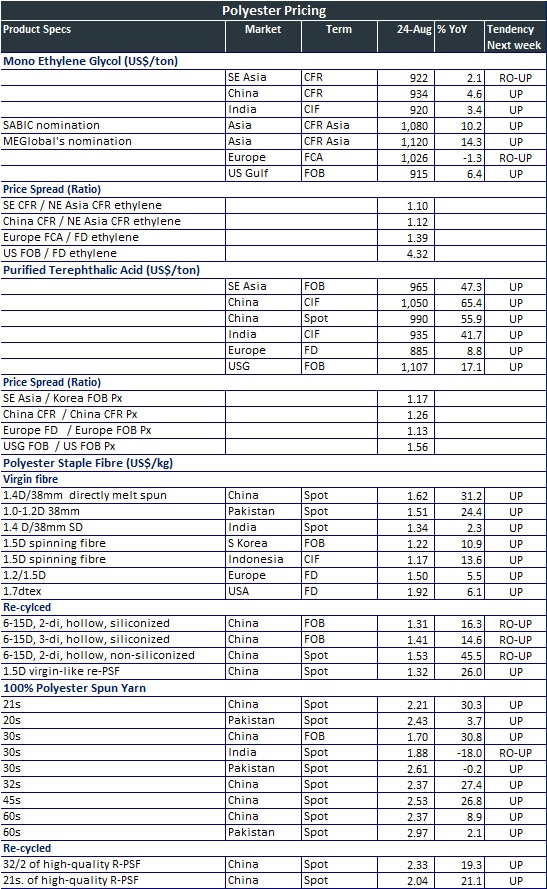

Polyester market drivers in the week of 24 August

Polyester fibre prices continued to surge on the back of rising purified terephthalic acid and also mono ethylene glycol cost in the week ended 24 August. However, trade activity was dampened as buyers hesitated to accept such a drastic hike in offers. The persistent strengthening of the US$ against most currencies also curtailed buying appetite.

Polyester spun yarn markets were supported by rising fibre prices in China while other Asian markets were taking cue to remain firmly stable. In Pakistan, spinners raised concerned over rising cost and a meeting was held in the previous week to consider the market situation. Yarn producers have urged the government to reduce import duties on fibre import from 7% to 2% as domestic polyester prices have almost doubled in the last year. Recently, producers’ offers were raised 20%, which has aggravated the situation. Yarn exports have become unviable and many spinners have decided to close down operations for up to 10 days in coming week. In India, stable polyester fibre prices supported spinners and yarn prices generally rolled over.

Polyester filament prices were also raised further in China in tandem with the movement in raw material. In Jiangsu, offers were hiked, with deals occasionally surfacing. Downstream mills adopted wait-and-see attitude, but low inventory and high chip settlement prices underpinned the sentiment. In India, selling indications for POYs rolled over as sales turned thin. In Pakistan, offers for DTYs rolled over for local produce and imported goods amid moderate trading atmosphere.

Upstream, PTA prices continued to march up in Asia on rebounding downstream polyester market. However, the momentum for spot prices slowed having reached a peak. PTA market is ready to brace any adjustment but in medium to long term, market will continue to go up unless fundamentals change. In Europe, PTA supplies remained short with feedstock prices elevated.

MEG prices reversed the two-week falling trend in Asia amid an increasingly bullish market sentiment with producers benefiting from short-covering by traders. Buyers started restocking ahead of peak demand season in September for polyester sector. In Europe, MEG bulk spot prices rose after some sustained stability on supply snug and bullish outlook for September. In US, MG prices were steady on balanced supply and demand conditions, as China began imposing 25% tariffs on US goods, including MEG.

The tabulation below covers polyester chain pricing for the current week (ending 24 August), previous week (ending 10 August) and also the tendency of price to move to be in the ensuing week (ending 31 August). The predictions for price tendency are closer to actual movements in 80 percent of the attempts. The price spread analysis helps to broadly understand margins of end-products vis a vis their material inputs.