Nylon prices moderate in Asia as upstream sobers entering April

Nylon prices (filament) moderated in the first week of April with most specs dropping at the upper end of the price range. This implies reduction in supply of costly goods as prices were influenced by insipid crude oil and benzene markets and weakening caprolactum spot market although contract market was firm. Soft chip market restrained any upside potential for nylon prices mainly of textile filament yarn, leading to discounts under aggressive selling. Demand for yarn was stable as textile producers maintained high run rates.

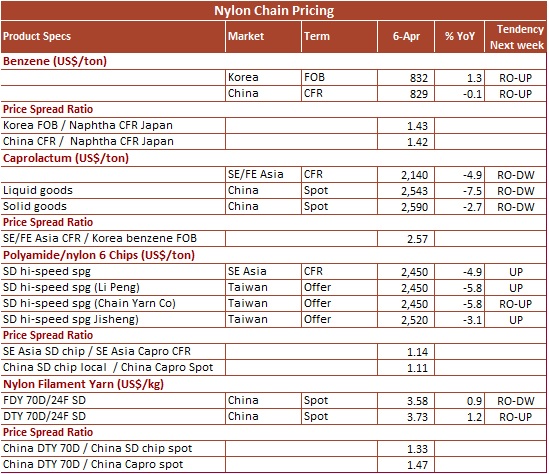

Buying sentiment was however, cautious given weak confidence and fewer new orders. It is likely that demand for nylon FDY, DTY and POY may turn tepid. In case of industrial nylon yarn, demand for cord fabric was good, while that for fishing net yarn and staple fiber was poor. In China, nylon FDY70D/24F SD prices declined US cents 8, while DTY70D were down US cents 3 at the upper end.

Nylon chip market atmosphere was cautious in a holiday shortened week in Asia, with overall sentiment lusterless. Prices moved in both directions as nylon yarn producers maintained high rates due to good margins in textile sector. Taiwan‐origin SD high-speed nylon chip prices rose US$20-40 a ton while offers from Taiwan Chain Yarn were steady for SD and FD chips, Taiwan Jisheng raised its offer by US$90 a ton for SD and FD chips. In China, conventional nylon-6 chip offers moved up at lower end and down on the upper while SD high-speed chips offers declined US$50 a ton.

Caprolactum markets were insipid in Asia in the first week while prices for liquid and flake materials declined amid light trading and low demand. Upstream benzene market was also range bound, prompting downstream derivative including caprolactum to dip. Asian SE and FE Asia caprolactum markers edged down US$10-20 a ton while spot prices in China moderated US$50 a ton for liquid goods and US$35 for flake materials.

Upstream benzene markets were under pressure of ample supply, a condition that may prevail until second half of H2 May when turnarounds undertaken. Demand was still lackluster and inventories along eastern China continued to build-up. Apart from China, other markets like Taiwan and SE Asia also saw poor off take as most users had sufficient stock to meet their near-term requirements. Demand may turn more uncertain following the escalating trade war between the US and China. Asian benzene markers the FOB Korea inched up US$7 a ton and CFR China US$5.50 a ton. JXTG Nippon Oil & Energy settled its April Asia contract price US$80 lower than March value.