Indian textile industry seeks protection from duty-free import from Bangladesh

Does the Indian textile industry – the oldest in written history, still need protection even from a smaller and poorer country like Bangladesh. The answer is seems to be a big YES if one goes by a recent government’s move to introduce Rules of Origin to protect its local garment manufacturers from imports from its neighbour Bangladesh.

Discussions are held stakeholders on a proposed ‘Fabric Forward Policy’ which aims at introducing the rules of origin for duty-free garment imports. Recently, import duties on more than 300 textile products were doubled to 20% on August 7 to reduce its cheap imports from China. But the textile industry claimed that their duty doubling did not hinder duty-free facility offered by India to Bangladesh citing that China was exporting textiles to India through Bangladesh.

The Confederation of Indian Textile Industry (CITI) stated that fabric made in China was entering India duty free through Bangladesh since it has zero duty access for all apparel products, and the customs duty hike will not impact those imports. In case of garments imported from China, it is the Specific Duties that are applied and not the Ad Valorem duty.

Imports from China at competitive rates is forcing some Indian businesses, such as polyester production facilities, to run idle, leading to job losses, CITI claimed.

Kavita Gupta, textile commissioner, recent told Reuters that the textile ministry has proposed a Fabric Forward Policy, where duty-free access to garments would be provided if the fabric was sourced from India. Adding further that the policy was in discussion stage.

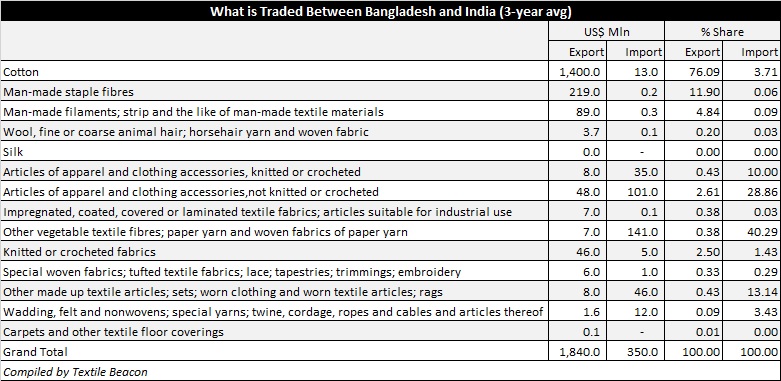

However, if one broadly analyse the textile trade between the two countries, using data from UN sources from HS code 50 to 63, India’s imports from Bangladesh averaged US$350 million between 2015 and 2017, while its export to that countries averaged US$1,840 million during the same period, more than five times of what it imports.

Further deciphering reveals that 40% (US$141 million worth) of the import relates to Chapter 53 Other vegetable textile fibres; paper yarn and woven fabrics of paper yarn. This also includes jute fibre and articles, which is the major domestic industry in Bangladesh. The other major item of import is articles of apparel and clothing accessories, knitted or crocheted or not, which account for another 40% (US$136 million worth). As against this, India’s single major item of export to Bangladesh is cotton and its products (Chapter 52). Its export averaged US$1,400 million accounting for 76% of all textiles export to Bangladesh. The next major item is man-made staple fibres and its products (Chapter 54) accounting for 12% or US$220 million.

This clearly indicates that India already export fibre, yarn and fabric a larger quantity than it imports from Bangladesh. The total value of import and export between the two does not corroborate the claim for protection. It is also pertinent to know from where such a demand is emerging within the Industry.

One should also note that for Bangladesh, India is the second largest supplier (16%) of textiles, preceded only by China (35%) and followed by Hongkong (14%). For exports US, Germany and United Kingdom are the top destinations while India ranks only 17th in terms of export value.

This implies that India export raw material to Bangladesh which is converted into end use goods and exported to the rest of the world and negligible portion comes to India.

It will also not be easy for India to impose any condition on duty-free facility as Bangladesh enjoys the trade benefit in India under the South Asian Free Trade Agreement pact.

What if Bangladesh retaliates with a similar move, and bring down its dependence of raw material from India. Which door will the Indian textile industry knock for protection then?