India doubles duty on textile products, but B’desh enjoys duty-free

The government has doubled import duty on textile products including carpets, woven fabric, jackets and baby garments, among others. In a notification issued on 17 July night, the Central Board of Indirect Taxes and Customs listed textile products on which duties were hiked from 10% to 20%. However, there was no mention of date of these duties coming into effect.

The decision to increase import duty on 76 textile and apparel items at 6-digit level, is a move to provide a major relief to the garment and carpet manufacturers who were under immense pressure post the launch of goods and services tax (GST).

The import duty has been doubled from 10% to 20%. The list of products under the new duty includes 24 knitted apparel categories, 24 woven apparel categories, 10 categories of carpet, 6 nonwovens categories, 3 categories of laminated fabric, 2 knitted fabric, 2 categories of woven fabric, 2 categories of madeups and 3 other categories.

On some items, the rate would be 20% or INR 38 per metre, whichever is higher. The ad-valorem rate of duty for certain items are also raised.

As per the WTO norm, the government will not be able to extend any further benefits to the textile sector.

However, imports from less developed countries will remain duty-free, including Bangladesh. Import from Bangladesh is fully exempted from Basic Customs Duty and hence it is a gateway for Chinese fabric entering India duty-free. This is because no Rules of Origin (RoO) are in place for duty free imports from Bangladesh.

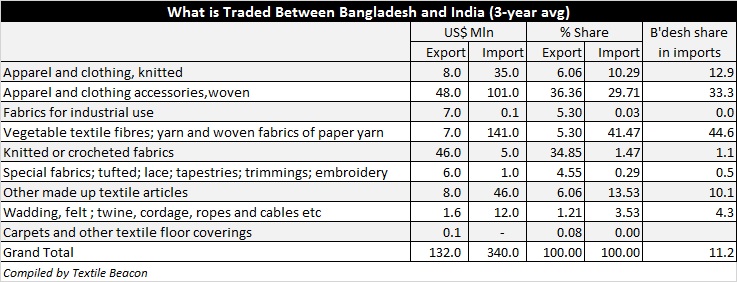

Bangladesh is the largest supplier of most of the goods on which duties are doubled. Over the past three years (2015 to 2017), apparel and fabric imports from Bangladesh accounted for over 11% of total imports. It was close to 14% in 2016, but decline in 2017, which pulled down the share to just above 9%. Imports from Bangladesh declined by a sharp 43% and by 15% from the world. So, the doubling of import duty will not have any impact on goods flowing from Bangladesh, but they rather rise as imports from others will be costlier.

Deciphering the product-mix trade between India and Bangladesh, the latter import raw material from the former and export value added goods like fabric and apparel clothing to the world. The textile industry in Bangladesh has been structurally developed to manufacture value added textile products, due to lack of raw material, which it relies on imports from surplus countries like India and USA.

India is the second largest supplier (16%) of textiles to Bangladesh, preceded only by China (35%) and followed by Hongkong (14%). For exports US, Germany and United Kingdom are the top destinations for Bangladesh while India ranks 17th in terms of exports.

Thus, it is imperative that the Indian textile industry move up the value chain and take the advantage of ample availability of cheaper raw material rather than seeking such shielding. If raw material from India can go to Bangladesh only to be converted into value added products in brought back to India, why can’t the Indian textile industry restructure and produce high value products. China is already moving up the value chain and moving low value production outside the country.