How cotton yarn markets react to change in cotton prices?

In my previous analysis we have seen that cotton prices were slower to rise in the last one year among the major fibres used in textile production globally. Further analysis into the downstream yarn markets provide insight of how they react to the change in cotton prices and whether they are able to consistently maintain sufficient spread.

[The analysis is based on various “Global Markets Weekly Review” published by Textile Beacon.com]

Here Texilebeacon.com attempts to analyses three major global cotton yarn suppliers, China, India and Pakistan. All have raw material base in their country and are top producers of cotton fibre. So we expose the yarn markets in these economies vis-à-vis domestic benchmark cotton price and the global indicator, the US Futures on the ICE, for the last 52 weeks ending 15 June 2018.

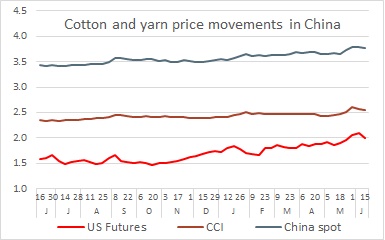

China

Over the past one year, cotton yarn markets in China are found to be quickly reacting to changes in domestic prices which in turn take cue from US Futures. Here, the China Cotton Index (328) represents the domestic cotton market. Yarn makers are able to maintain a spread (32s cotton yarn minus CCI) of 44-50% above cotton, which has become more pronounced since April. With some dip in late May, the spread and prices have recovered in June.

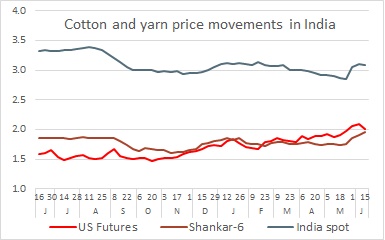

India

In India, some lag is seen in yarn prices picking up the line of cotton numbers. Here, benchmark Shankar-6 represents cotton and 30s cotton knitting yarn Ludhiana market is the indicator for yarn market. While cotton prices tend to pick when US Futures take an upward climb, but when US Futures falls, domestic prices do not move. A one year graphic shows this trend in the past 52 weeks.

With slightly lower domestic cotton prices and higher yarn prices last year, the spread was remarkably high in the range of 70-80% above cotton. But as cotton prices started moving up, yarn makers could not absorb the rising cost, and in fact had to cut prices to boost sales. This led to reduction in spread to sub-60% level in June. There was some rebound seen in yarn prices later as it was clear that high cotton prices are here to stay.

Pakistan

In Pakistan, yarn markets enjoyed the widest spread with its domestic cotton prices in comparison to India and China. The spread between cotton combed 32s cone yarn prices in Faisalabad were consistently higher than 100% to Karachi Cotton Association’s ex-Karachi spot rate. Yarn prices movement has been more or less in line with US Cotton Futures rather than domestic cotton rates.

1 comment on “How cotton yarn markets react to change in cotton prices?”

Very informative blog post.Thanks Again. Fantastic.