Cotton prices surge in May on adverse weather conditions

Cotton prices in India continued to surge in line with global trend and were further supported by the expected drop in sowing area this year. Overall, 65.52 lakh hectares (Lha) was sown under various crops until May-end, which was around 6% less than the corresponding period last year. Even though these are early days of sowing and better monsoon may dramatically change the situation. The drop in acreage under cotton is substantial. The planted area has is down 30% at 7.82 Lha under cotton. A substantial reduction is reported in Haryana and Punjab, where early sowing of cotton is normally taken up. Meanwhile, spot cotton prices jumped INR300-2,100 per candy across specs during May. Benchmark Shankar-6 was traded at an average of INR42,420 per candy, up INR1,245 from April.

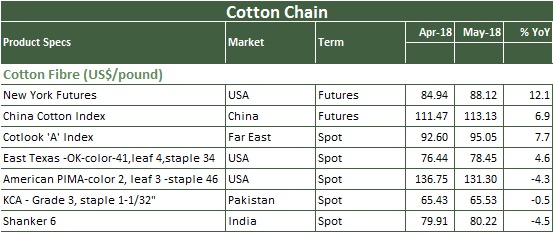

US cotton futures (July) rallied 3.7% during May, after climbing sharply by 4.6% in the last week. The rise in cotton futures was helped by buying from speculators amid concerns of hotter weather conditions in Texas, the major producing region of cotton in the US. The most active contract for December expiry settled up US cents 5.56 or 7% on the month after being traded within a range of US cents 91.21-93.00 per pound.

http://www.textilebeacon.com/market-info-3/

Meanwhile, the International Cotton Advisory Committee lowered its global cotton inventory forecasts for the 2018-19 crop year. In China, along with weather issues in the Xinjiang region, which accounts for 75% of China’s cotton area and potential drought conditions in West Texas affecting 25% of the US crop, there were concern of quality supply gaps which may affect next season’s supply, the ICAC said in its monthly report. The three states in the Southwest cotton region – Texas, Oklahoma and Kansas – are projected to plant cotton on 8.1 million acres, up from 7.6 million last year and the highest since an identical area was seeded in 1981. That would be 61% of the US upland acres.

The China Cotton Index surged more than 400 Yuan to average 15,896 a ton (US cents 113 a pound). Global spot benchmark, the Cotlook A index also surged US cent 2.45 on the month to US cents 95.05 per pound.