Acrylic fibre price stable as producers cut production

Acrylic fibre prices, a manmade substitute for wool, rolled over across Asian markets in the week ended 17 August. The flatness reflected thin trading activities and downstream yarn mills cutting operating rates to lower levels. However, high acrylonitrile cost supported acrylic fibre markets, and there was little room for any price adjustment, unless producers’ margins squeeze. Still producers were not able to transfer the rising cost down to end-users due to the off-peak season. They preferred to shut down plant or reduce operating rates.

In China, acrylic fibre plants were running at an average rate of 52% in H1 August and this reduced level is expected to be maintained for the rest of August. In July, the plants had registered an average run rate of 85%. China has 13 acrylic fibre producers and India three. Pakistan has none.

Acrylonitrile (ACN)

The support to acrylic prices was largely coming from acrylonitrile markets, which saw prices rolling over firmly in Asia with some moderation in China now. Supply was tight on the back of limited operations due to plant maintenance. Demand was also flat as downstream users ran at lower run rates.

In Europe, a second August contract price was settled up from July following increases in ammonia and propylene prices. ACN supply was tight in the region due to force majeure across INEOS’s European operations. Import levels were also limited by high prices in other markets. In US, export prices remained firm at higher levels amid robust demand and snug supply conditions.

Propylene

Asian propylene markets were on a bullish tone in the week of 17 August, boosted by limited supplies amid steam cracker turnaround season. Participants were eyeing steam cracker operations of key producers with Mitsui Chemicals restarting last week. The cracker is able to produce 300,000 million ton of propylene per year.

In Europe, supply tightness continued in propylene market and spot prices were at a premium to contract price. In US, prices fell as supply improved after production outages were resolved and inventory levels climbing for six weeks.

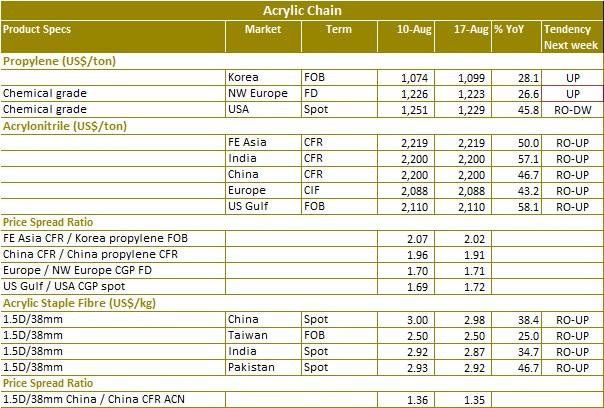

The tabulation below covers nylon chain pricing for the current week (ending 17 August), previous week (ending 10 August) and also the tendency of price to move to be in the ensuing week (ending 24 August). The predictions for price tendency are closer to actual movements in 80 percent of the attempts. The price spread analysis helps to broadly understand margins of end-products vis-a vis-their material inputs.