When will textiles tide over coronavirus crisis – Part 2

When will textiles tide over coronavirus crisis Part 1 had summarised the current status and had attempted to find some clue of recovery in terms of economic growth in the similar but of less destructive previous economic crisis of 2008-2009. In both the crisis we have seen demand shrinking rapidly and textile prices pushed down and down. Let us first look at the trends in pricing that prevailed in 2008-2009.

Our basic tenet assumption is that, under any circumstances prices reflect demand levels. They begin to decline rapidly when demand shrinks and as a consequence, values across the textile chain start collapsing to touch new lows. And when prices start moving up, it is only because demand begin to look up to revive and then rebound, whatsoever the measures are taken to revive the economic growth. We reiterate that demand for textile is strongly correlated with income level and its growth while price is only a reflection of demand. Thus, movement in prices will provide basic clues of the potential revival in demand and the duration of descending and ascending of prices. This means, the point of time when prices start falling and touch the low from where it begins to reverse and the time to come back to the levels from where they began their downward journey.

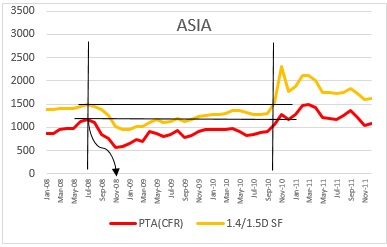

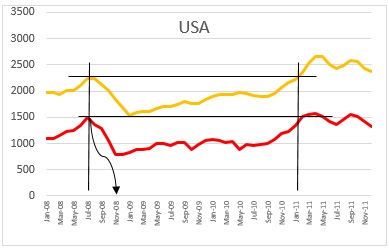

Here we select two fibre chains, polyester and cotton to study the finds clues. They both account for more than 70% of all kinds of fibres used in textiles. Within polyester, we look at purified terephathalic acid (PTA) and polyester staple fibre (PSF). In cotton, the markers representing are US cotton Futures and the Cotlook Index. In this part, we take up knowing the polyester chain to study coronavirus impact on demand. (All values are in US$/ton basis).

In Asia, declined in polyester chain began in July 2008 when PTA prices began to descend and followed with some lag in PSF. They kept falling until November 2008 for about 16 weeks. After touching the low, they gathered upward momentum but hovered below the July levels when the fall began. They could reach the July levels only September 2010, taking almost 27 months. Thus, it appears that although recovery took more than two years, the very short period of initial 16 weeks were more crucial for the industry to survive. In 2008, China accounted for close to 60% of both global PSF capacity and supply.

In Europe, declined in polyester chain also began in July 2008 with PTA and PSF prices began to fall. They kept falling until January-February 2009, taking a longer time than Asia of about 24 weeks. After touching the low, they gathered upward momentum but hovered below the July levels until January 2011, taking almost 31 months. In 2008, Europe accounted for less than 5% of both global PSF capacity and supply.

In USA, the trend was mostly like Europe with the declined in polyester chain beginning form July 2008. The fall continued until November, taking the same time like Asia of about 16 weeks. After touching the low, the upward momentum was maintained they reached the July levels in January 2011, taking 31 months. In 2008, North America accounted for just over 4% of global PSF capacity.

Overall, it is apparent that demand shrinkage represented by prices lasted for about 16-24 weeks or 4-6 months in the 2008-2009 financial or economic crisis. But it took about 11 quarters in Asia to come back to pre-crisis level in Asia. Post the eventuality, China ramped up its polyester making capacity to 65% in 2010-12.

In our concluding Part – 3 will juxtapose the 2008-2009 polyester pricing trends with the current trend (coronavirus crisis) along with cotton. The next few weeks are crucial to watch the developments, since China already returning back to normalcy with very few pockets of lockdowns. But this return will only revive the local or domestic demand, as rest of the world still remain in lockdowns to contain coronavirus spread and have shut all their inward movement of goods. So there is no destination for Chinese textiles at the moment.

To be concluded…