Cotton export ends 2018-19 on a disappointing note

Cotton export in marketing year 2018-19 (Oct-Sep) ended with a disappointed performance. During the year, only 5.46 million bales were exported, down 37% compared to the volume exported in the 2017-18 season. By value, export declined 32% in INR and 38% in US$ terms. The last month of the marketing season, September shipment was less than 15 thousand bales (170 kg each) exported.

Although, the year began on a very high note with shipments jumping 70% in the first two months from their levels in the previous season and earning rising 54% in US$ terms. During these months, average export prices were below Cotlook A index, the global benchmark for spot trade. But they were higher than US cotton futures and domestic prices, benchmarked to Gujarat Shankar-6 variety. However, the situation changed rapidly and the euphoria faded entering the peak season.

The next four months (Dec to Mar) saw shipment dwindle 30% as just 3.5 million bales could be exported as against 4.95 million bales in the same period of 2017-18. During these four months, average export prices were still higher than Cotlook, but the gap between the two had tapered and very thin. Compared to domestic prices, export prices were considerably higher.

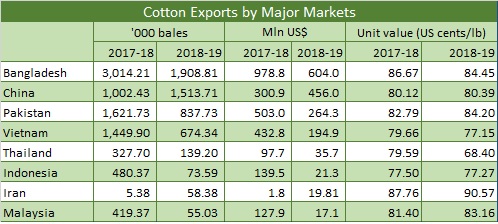

This implies few factors worked against the export performance. One, Indian cotton was uncompetitive in the peak season as prices almost matching or higher the global prices whereas domestic cotton was cheaper. And two, there was complete void of authentic estimate on the crop size, although area sown was known although talks were that this year crop will be lower. The third factor was significant drop in export to major markets, despite China importing a lot of cotton in the initial part of the year. However, no export to China was noted between June and September this year.

Bangladesh, Pakistan, Vietnam, Thailand, and Indonesia, the major market for Indian cotton reduced their need from India. Also price difference worked negatively for most. For Bangladesh, the top buyer, the average price was US cents 84.45 per pound, about US cents 3.49 more than Cotlook average. Similarly for Pakistan, the third largest importer, the difference was US cents 3.23 per pound. Both these markets accounted for about 52 of value of cotton export during the year. For China, Vietnam, Thailand and Indonesia the average price was lower than Cotlook. This could have been probably because China has invested in spinning capacities in Vietnam and Thailand and could negotiate a better deal with Indian exporters.