Polyester prices remain range bound in third week of New Year

Polyester prices, both fibre and filament yarns, were range bound in the week ended 18 January. They are likely to remain so until the Lunar New Year festival in China in February. Most producers have either shut down for holidays while some were in the process of winding up. Thus polyester prices may not see significant move going ahead.

Polyester prices up in Pakistan

Polyester staple fibre or PSF markets in China stabilised and producers liquidated goods with offers in Jiangsu and Zhejiang rolling over. Discussions generally rolled over ahead of Lunar New year holidays. In Pakistan, PSF producers lifted offers implying passing over rising cost and firmness in cotton markets. In India, prices were stable after they were cut in early January.

Polyester filament yarn or PFY markets were calm in Asia and local offers in China mainly roll over amid lukewarm transactions, seeing downstream mills purchase from hand to mouth volume and consuming their stocks. In India, producers’ price for POYs were unchanged amid modest sales while DTY offers in Pakistan both for local goods and imported material rolled over

Polyester yarn markets remained firm driven by high feedstock cost while offers were heard rolling over amid slow liquidity. Some spinning mills had already left for holiday in China as demand in fabric market was weak. In India, polyester yarn prices did not change after they were cut earlier. In Pakistan, polyester yarn prices did not move despite PSF makers hiking offers

Polyester intermediates

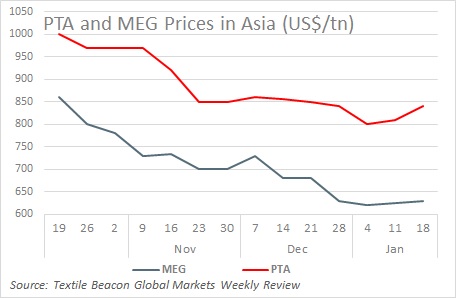

Purified terphthalic acid or PTA prices gained in Asia on rising offtake from polyester makers ahead of Lunar New year holidays. However, the rise was capped by low interest to build long positions as terminal demand remained weak for initial few weeks after the holidays. In Europe, January contract prices dropped for the fourth consecutive month, following decline in Px contract for the month

Upstream paraxylene prices in Asia moved in a narrow range as they just managed to inch up amid ample supply and steady demand. In Europe, spot price edged down a bit as January contract price settled down compared to December, following a split settlement. In US, spot Px prices narrowed on the lower end alongside slightly higher crude prices and declining refinery rates in the US amid the start of refinery maintenance season

Mono ethylene glycol or MEG prices declined in Asian markets despite they inched up weekend due to increased offtake volumes and in line with an increase in crude values. Demand was weak as downstream polyester producers cut operation rate ahead of the Lunar New Year holidays while supply was ample. In Europe, spot prices continued to tumble on flat demand and downcast mood prevailing in the market. Demand was hard to pick as expected as peak antifreeze season was approaching the end. In US, MEG market continued to face headwinds from long supply and sluggish demand

Feedstock Asian ethylene markets resurrected previous losses as prices jumped sharply for the first time in three weeks, aided by pre-Lunar New Year replenishing and following an outage at a key European supplier. In Europe, ethylene market remained soft amid lengthy supply and lacklustre demand, but this was offset by unplanned cracker outages, plus trims on cracker operating rates. In US, spot ethylene prices rose amid higher demand and slightly higher feedstock costs

Forecast for January

Polyester prices in January in Asian markets will enter a weak demand season, as China prepares for the Lunar New Year Festival which is celebrated almost over a week in February. Most fabric makers have already planned to stop operation in advance as they have completed their business and will focus on payment collection. However prices will be support by the small up-tick crude oil and PTA cost going into January. Export offers for China-origin PSF cargoes had fallen in December, tracking the stronger Yuan and slowdown in global macroeconomics. Similar reasons are expected to continue. The positive sign will emerge from the final settlement of US-China trade war. European and US polyester markets will also move in line with Asian markets as they prone to cheaper imports.

Source: Global Markets Weekly Review, Global Polyester Price Forecast – Monthly Report

1 comment on “Polyester prices remain range bound in third week of New Year”

Great blog. Really Great.