Nylon prices will remain supported by caprolactum, but how long?

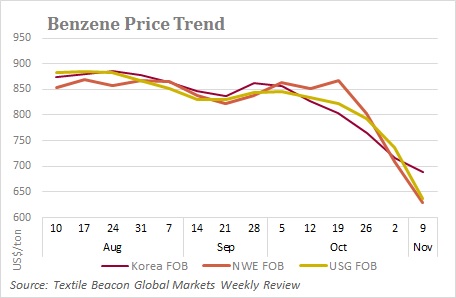

Nylon prices have remained supported by stronger caprolactum in Asian markets despite the tumble in benzene cost. In the week ended 9 November, caprolactum prices were corrected but they were still higher by 4% than a year ago. In similar comparison, benzene prices were down 17% year on year. Benzene was also cheaper in US by 38% and by 30% in Europe in similar comparison. Both regions were over supplies and were looking at opportunities in Asian markets. However, benzene price movement were more in line with down styrene markets. Nevertheless, the question is how long the strength in caprolactum will continue while also to be noted that producers resort to production controls to hold price levels. Will nylon prices remain supported.?

Asian caprolactum markets were quiet amid uncertainty and volatile prices in domestic market of China. Spot markets were range bound given the lower benzene cost and thin demand. With a major Asian producer expected to release its offers next week, spot markets were bearish and prices range bound. In Europe, October contract were concluded down on lower October benzene costs. November discussion will be not easy as suppliers were aiming for stability, despite lower feedstock costs. Worries about weaker automotive demand including the nylon 6 market, along with concern of outlook due to macroeconomic and political uncertainty.

Benzene prices in Asia declined despite some rebound in the second half of the week ended 9 November. Discussion levels declined in the first half, dampened by bearish European and US markets, tepid recovery in domestic market in China and muted buying interest. European spot benzene prices dropped to a 29-month low while US spot plummeted to a two-year low following a sharp decline in oil prices along with slow demand for downstream styrene sector.

Polyamide or nylon chip liquidity was thin, with price movements divided in Asia. Offers from Taiwan were stable while those in China saw low end prices of semi dull chip declining while upper end of conventional chip rising. Demand for chip was stable as nylon yarn producers ran at flat rates. In Europe, negotiations for November nylon were on a slow start as discussions were in early stages following settlement of November benzene contract last week.

Nylon prices for filament yarns dipped as upstream caprolactum spot market was insipid but contract prices were still high. Nylon chip price movements were also divided. Downstream demand was rigid as textile producers operated at low run rates. Purchasing volume of FDY, DTY and POY were on need based volumes.

(Source: Global Markets Weekly Review. For full report write to us at sales@textilebeacon.com)