Cotton loses peak export sheen in India

December is usually the peak month for cotton export and the third month of a new marketing season. No other month match the volume of the last month of a calendar year. This December, shipment was less than 7 lakh bales (170 kg each), taking the seasons (2019-20) total to just 13.3 lakh bales or 1.33 million bales.

The export volume in corresponding months of 2018-19 was 24.2 lakh bales, 21.1 lakh bales in 2017-18, 21.6 lakh bales in 2016-17 and 34.3 lakh bales in 2015-16.

It is also apparent that export in the first three months of a new season have been on a rapid decline since 2016-17, the year of value currency notes demonetisation. Does this imply that the impact of demonetization still persist or not faded? May be yes, because there was no large crop failure caused by either monsoon or pest attack in 2019-20 which can adversely impact export.

The CAI stated that the 2018-19 crop stood at 312 lakh bales, which was a record low as against 365 lakh bales in the previous year. However, for the current season 2019-20, its crop estimate stood at 354.5 lakh bales. Thus, cotton trade has been sharply fluctuating amid varying crop size and thereby prices moved over the past one year. This season’s drop in export is attributed by CAI to multiple factors, including higher domestic prices compared to international prices because the thin crop last year.

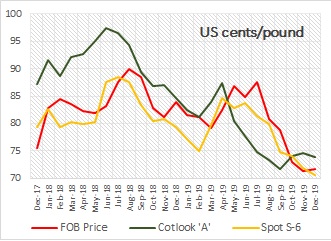

With 13.3 lakh bales exported this season worth US$US$359 million, imply an average price realisation of INR112 a kg or US cents 71.74 per pound. This was lower compared to Cotlook A index, the global spot price benchmark for cotton and Gujarat Shankar-6, the benchmark for domestic spot price. During the three months, Cotlook averaged US$74.20 per pound and Shankar-6 US cents 72.16 per pound. Compared to the average values of the same of previous season, Cotlook was down 14%, spot Gujarat Shankar-6 down 10% and export realization down 13%. So attributing pricing to be a cause for export dropping is apparently unfounded. There was some upward movement in prices recent months, but that cannot be a deterrent for export.

In December, Bangladesh was the largest market for Indian cotton export, followed distantly by China, Indonesia and Vietnam. Negligible volume (570 bales) was shipped to Pakistan, which was one of the largest market with shipment of 2.20 lakh bales in December 2018.